FASB/Reserve Compliance Reporting Service

Coordinator of Compliance Reporting Program: Jackie Robertson

For Compliance Questions and FASB / Reserve Report Onboarding, please email: jrobertson@pgcalc.com

Availability: Monday – Friday,

8:30 am – 6:00 pm Eastern Time

Jackie Robertson, Client Services Assistant

Samantha Akiha, Client Services Advisor

Kara Morin, Director of Client Client Services

Jen Wickham, Senior Client Services Advisor

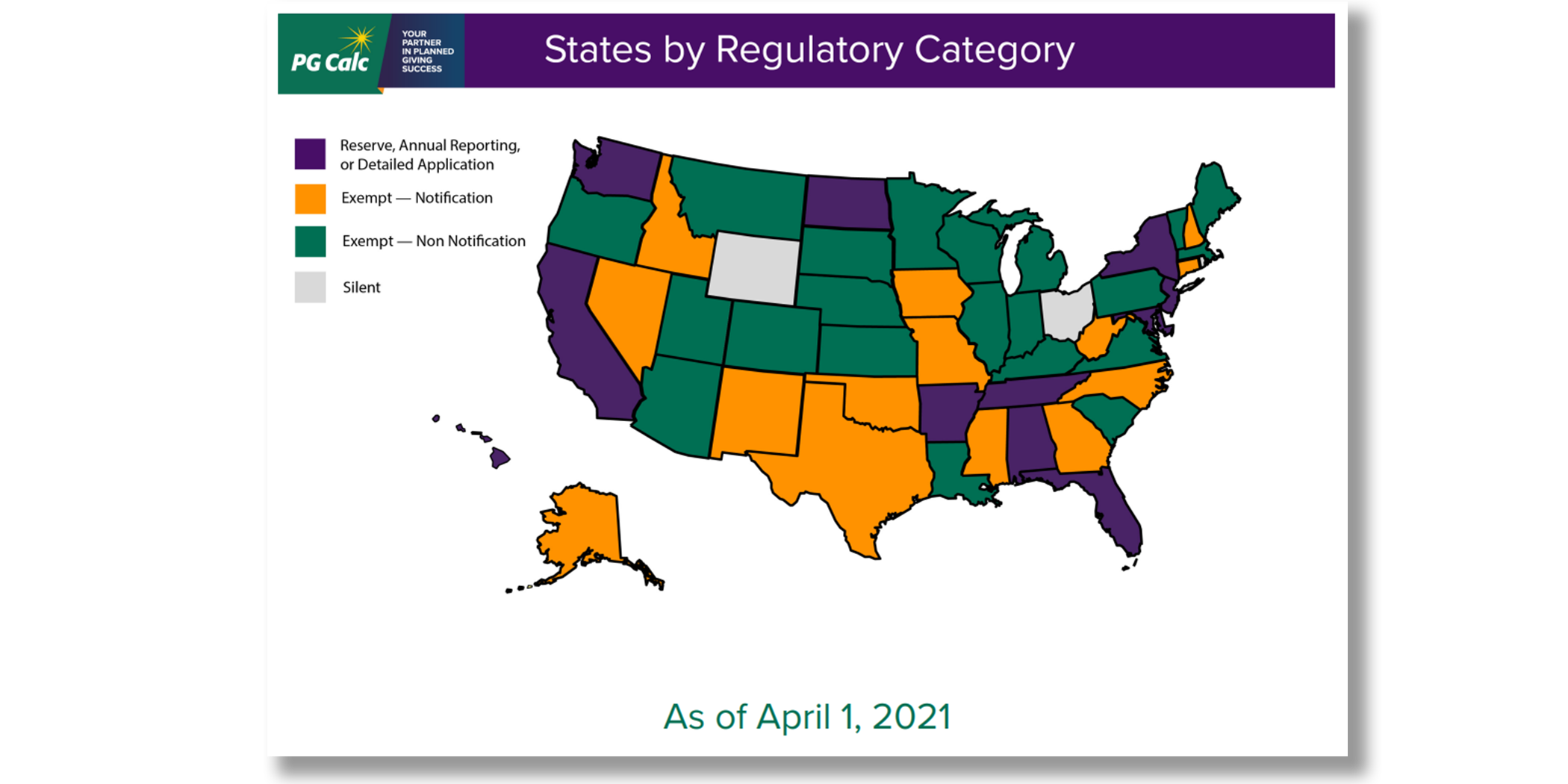

- CGA State Reserve Reports: Being compliant with state requirements for charitable gifts is a complex and time-consuming endeavor. We can easily provide you with accurate and timely CGA State Reserve Reports to ensure your report is ready before the due date.

- FASB Liability Reports: Determining the liability represented by each of your organization's split interest gifts, such as gift annuities and charitable remainder trusts is a long process. We can provide you with the reports and save you time.

- Our Compliance Reporting Service Entails: Providing Reserve Reports for every state regulating CGAs; Providing reserve reports verified by a qualified actuary, for states requiring it; and Providing FASB Reports for CRT, PIF, and CGA gift types.

2024 Schedule of Fees for Compliance Reporting, Actuarial Verification, and Database Maintenance

Request a CGA State Reserve report or a FASB Liability report

To request either a CGA State Reserve report and/or a FASB Liability report, please complete the intake form located here:

Click Here to Download Intake Form

Please note, this is a new URL, and we recommend you bookmark the link.

Our Response Time: The turnaround time for reports with actuarial verification is 15 business days, and 5 business days for unverified reports, both counting from the date the data is approved. Holidays and weekends are excluded from the turnaround time, so please plan accordingly.

If PG Calc maintains your data, and you select “yes” on the intake form to indicate that you have data changes to report, please fill out the following Excel spreadsheet with your data changes. Please update the spreadsheet with any new gifts, beneficiary deaths, or gift severances, along with the relevant information for each gift record.

On the same spreadsheet, please update the market values for all charitable remainder unitrusts and pooled income fund gifts as of their valuation dates.

The data change spreadsheet will be sent to you via encrypted email, and if you return the report by replying to the same encrypted email your response will automatically be encrypted.

If your planned gift data is maintained by an outside gift administration vendor, or if you maintain your data in-house using GiftWrap, your planned gift data should be prepared according to these Format Requirements. Once you have completed the intake form, you may send your reports to us via email at support@pgcalc.com.

Please note, if your charity has either commuted payment gift annuities (sometimes referred to as “college tuition gift annuities”) or flexible gift annuities (a type of deferred gift annuity), these gifts require special handling. Please follow the steps necessary for flexible gift annuities here. Instructions for commuted payment gift annuities can be found here. Once these steps have been followed, please send the reports to us at support@pgcalc.com.